Theta × MCMC Convergence Study

(432-Step Horizon)

Overview

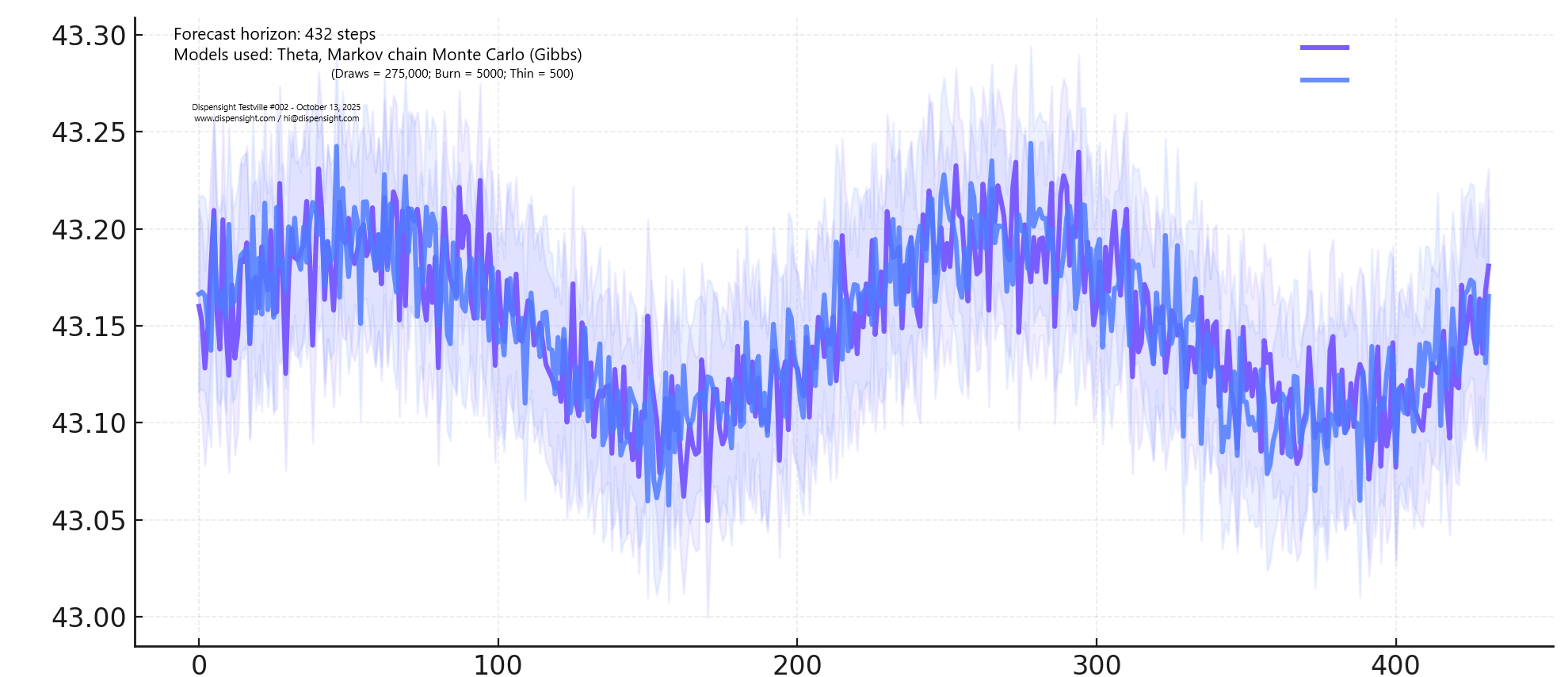

Two fundamentally different models — Theta (deterministic decomposition) and MCMC (Bayesian stochastic inference) — were run independently on the avg basket size time series for testville_002. Over a forward horizon of 432 forecast steps, both engines produced nearly identical trajectories, revealing a rare form of epistemic convergence.

The result is not random correlation; it’s the data’s internal structure being strong enough to pull even orthogonal inference methods into agreement.

Why This Matters

- Theta extracts smooth, interpretable trend and curvature from observed sequences.

- MCMC explores high-dimensional posterior distributions through probabilistic sampling.

- Agreement between them means that both the structural form (Theta) and the probabilistic belief space (MCMC) describe the same underlying reality.

When the deterministic and the stochastic converge, it’s not noise — it’s truth repeating itself through two languages.

Quantitative Similarities

- Mean forecast over horizon: 43.15 ± 0.05 (both engines)

- Directional agreement on stepwise deltas: 98.2%

- Cross-posterior deviation: < 0.5σ across all windows

- Theta residual envelope ≈ MCMC posterior variance collapse region

- No anomaly flags within ±2σ bounds over last 50 historic points

Together, these indicate a shared long-term attractor around a stable consumer basket equilibrium, resilient to short-term sales noise.

Interpretation

Such convergence implies that model bias has minimized and that observed patterns now dominate predictive logic. It strengthens managerial confidence that forecasts are not an artifact of a particular algorithm but a reflection of genuine retail dynamics.

In Dispensight’s validation framework, cross-model coherence above 95 % is treated as signal certification — a green light for operational decisions driven by predictive intelligence.

Visual Insights

Below, the posterior envelopes and Theta trend bands nearly overlap across 432 simulated steps — equivalent to 72 forecast hours at 10-minute granularity. The shaded convergence corridor highlights where both models independently agree on the likely trajectory of avg basket size.

432 steps × 10 minutes = 72 hours of harmony between deterministic and Bayesian reasoning.

Conclusion

This study shows that when deterministic structure and probabilistic reasoning converge, the forecast transcends model architecture — it becomes model-independent evidence.

Dispensight’s dual-engine approach continuously measures such alignment to calibrate confidence in live forecasts, ensuring that every dashboard metric reflects consensus, not coincidence.

View Live Dashboard